What happens when more than two thousand property management professionals share their insights, experiences, goals, and anxieties in one focused census?

You get the NAA Pulse Survey.

At the end of August, National Apartment Association (NAA, a multifamily industry pillar for the uninitiated) published its 2023 Property management Industry Pulse. It’s an annual staple for anyone invested in the current and future trends of the multifamily industry, and this year’s survey uncovered a great deal about the direction our collective businesses are taking and the shifts we’ve seen in the 18 months since their last Industry Pulse.

The New Worry King? Operational Efficiencies

From the survey’s headline to its opening salvo of insights, anxieties and intentions around operational efficiency have officially become the number one issue on property manager’s minds. While operational efficiency has always been a top multifamily industry challenge, this year’s census results supplanted HR, staffing, and recruitment from the 2021 survey. It’s not especially surprising, given that fears around a U.S. recession have measurably dampened enthusiasm for hiring throughout our industry and rising interest rates have already put a squeeze on profitability. In fact, according to the census, maximizing revenue and profits rose to #2 among the surveyed challenges.

Our take? It’s a noteworthy (if contradictory) set of challenges. There’s an inherent friction between property managers striving to achieve more efficient operations and maximize profitability while also slowing down or outright freezing hiring. To meet their goals in a climate of slowed growth, property managers are going to have to find new and better ways to do more with less.

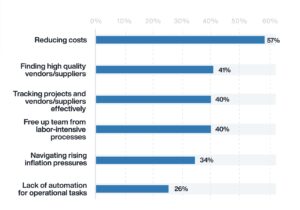

As a concept, “operational efficiencies” is a catchall that can mean very different processes and business goals. According to NAA’s survey, the most challenging activity related to operational efficiency in 2023 was reducing costs. In fact, 57% of respondents rated this as their most difficult obstacle. While that result is in no way surprising, the other contenders for most difficult aspects of operational efficiency were actually quite nuanced:

- Finding high quality vendors and suppliers (41%)

- Tracking projects and vendors/suppliers effectively (40%)

- Freeing up their teams from labor-intensive processes (40%)

*Graphs created by Appfolio

These results tell a clear and insightful story: property managers, constrained in hiring and pressured to operate more efficiently, are turning more and more to outsourced work and suppliers. And while saving on employee salaries and benefits can be a definite boon, the industry is also learning that managing vendor services can be detrimentally time-consuming and labor intensive. The TLDR; property managers need a way to relieve their teams of time-consuming tasks that lessen the load on their staff and allow them to work more seamlessly with partners.

Anxiety King Runner Up? Maximizing Revenue and Profits

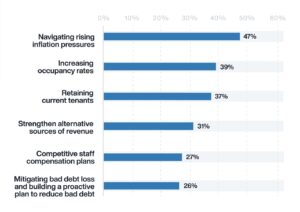

The second most prominent concern for the multifamily industry also had a lot to teach us about the shifting behaviors and pressures from residents. It’s breakdown of sub challenges?

- Navigating rising inflation pressures (47%)

- Increasing occupancy rates (39%)

- Retaining current tenants (37%)

*Graphs created by Appfolio

The unprecedented year-over-year hikes we’ve seen in multifamily rent appear to have all but stalled out. Where just last year some of our clients were lauding almost 20% upticks in annual rent growth, we’ve already seen a massive rise in the number of concessions that complexes are leveraging to remain regionally competitive. It’s an effective strategy, but it also has a short runway. There are only so many fiscal concessions businesses can make before they start to dip into the red.

While there is little that anyone in the industry can do to directly affect inflation, creating value for residents without cutting into profits will be the name of the game in 2024. Many of the concessions we’re seeing are knee-jerk reactions and time-honored ways of drawing in residents (first month free, waving pet fees, etc.). But for long term success in a hazardous economy, organizations will have to take an analytical approach to investing in new features and services for tenants, choosing only those that will deliver a measurable, positive ROI.

When Hiring Slows, Having the “Right” Staff Matter Most

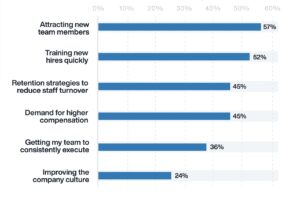

The spread for HR in the survey reveals a hiring world that’s on fire. Even as hiring has slowed, the mechanisms around hiring have become more important than ever.

- Attracting new team members (57%)

- Training new hires quickly (52%)

- Retention strategies to reduce staff turnover (45%)

*Graphs created by Appfolio

So in a recession-anxious economy where workers are happier than ever to land a stable position, what resistance are property managers running into when bringing on new staff?

Boring, redundant work. Recession aside, census after census over the last year has shown that employees in all strata of their career progression expect a higher quality and sophistication of day-to-day tasks than ever before. Multifamily firms that can offer their staff more challenging and stimulating work will be strongly positioned to poach talent and attract the best potential candidates. It’s why more and more multifamily businesses of all sizes are turning to automation to lower the amount of tedious or repetitive work inflicted on their employees–from chatbots filtering prospective residents to managed-utility services handling bill payments and resident billback.

The Best of the Rest? Other Noteworthy Findings

Here, we’ll provide a quick snapshot of the major obstacles the survey reviewed, their respective breakdowns, and a few accompanying thoughts and insights.

Stakeholder Experience

The top challenges were resident satisfaction (61%) and improving response time to residents (35%).

OUR TAKE? In this industry, resident satisfaction and resident response time are DEEPLY connected issues. Considers investing in 24/7 chatbot services to provide rapid responses to resident inquiries or managed utility services with dedicated resident support teams.

Risk/Compliance/Regulatory

The top surveyed challenges included “staying compliant amid constant new regulation” (61%) and “mitigating the increasing costs and burdens of regulations” (41%).

OUR TAKE? This ones a doozy. By every qualified measure, all forms of property regulations from “simple” ESG reporting requirements to robust building performance standards are slated to rise alongside the growing severity of fines. All salesmanship and marketing aside, we STRONGLY recommend partnering with vendors that provide regulatory coverage and compliance as an integral part of their service. And on the ESG front, consider a full stack solution that will give your business everything from automated, pre-formatted ESG reports to full blown consulting guidance on critical retrofits and upcoming regulations.

Altogether, the NAA Pulse Survey has once again functioned as a pillar source for understanding, predicting, and navigating the multifamily industry. Operational efficiencies have taken the forefront as a concern that all of us, vendors and complexes together, are dealing with. As the pressures of a difficult economy settle in, maximizing cost savings and protecting your employee knowledge base will become increasingly crucial.