ESG (Environmental, Social, Governance) isn’t your average boardroom buzzword. Contrary to recent politically-driven backlash, ESG is not a political tool. ESG is a framework used to evaluate or measure business strategy. It transcends political agendas to focus on the core aspects of business outcomes linked with environmental stewardship, social responsibility, and governance practices.

At its core, ESG performance and disclosure represent a critical lens and business practice that enables companies to navigate risk, identify opportunities, and enhance operational efficiency, while providing investors with transparent information. Transparency aids investors in making informed decisions, incorporating the potential impact on all stakeholders—including employees, customers, communities, suppliers, and financiers—thereby aligning closely with a company’s financial health.

Frameworks vs Scores: A Distinct Difference

It’s important to differentiate between ESG scores and frameworks. A framework is a lens to consider the opportunities and risks associated with business topics relating to ESG. Whether it’s cutting energy costs to meet Building Performance Standards (BPS) or boosting employee diversity for better retention and savings, a framework guides your strategic approach.

An ESG score could help measure a particular entity’s specific ESG attributes, serving as a critical tool for investors to gauge long-term prospects, risk, and non-financial performance. A score by itself may not be particularly useful. It doesn’t tell the full story. Taking a deeper dive – possibly through various ESG reports – reveals the nuanced insights necessary for informed investment decisions.

Materiality: The Linchpin of Decision-Making

Materiality is a key accounting concept defined as information with a substantial likelihood that an investor would consider important in making investment decisions or that’s reasonably certain to have an effect on a company’s value. According to the SEC, this information should be disclosed. This principle is fundamental in guiding what information should be transparently shared.

The Business Imperative for ESG

Adhering to ESG principles is not solely about regulatory compliance or attracting investor interest; but a strategic approach to risk mitigation and sustainable business practice. Whether preparing for the impacts of climate change, fostering diversity in leadership, or addressing global health challenges, properly evaluating ESG considerations and making associated improvements can position companies for long-term resilience and success.

It’s a way to mitigate risk.

Sustainability is the ability for something to be maintained at a certain rate or level. By preparing for long term business risks like climate change, diversity, and global health, your company will be better equipped in the long run.

Consider, for instance, the benefits of analyzing your business’s exposure to climate change. Not only will you be more prepared to face the battery of climate events that could harm your profitability, you’ll also be better positioned to attract investors who include climate risk exposure as a factor in their decision-making.

A second example of ESG leading to better business outcomes? Diversifying leadership. A uniform board might overlook what a varied leadership team can spot: opportunities to resonate with and satisfy a diverse and growingly conscientious customer base. Diversity means understanding and meeting the needs of all your customers, securing their loyalty, and driving your success.

Optimize performance

Access to robust ESG data is instrumental in driving operational performance. By minimizing resource consumption and waste, companies not only reduce costs but enhance their market positioning through responsible business practices.

Attracting talents & customers

On average, consumers are willing to pay more for a product or service if they know it is sustainable. If you own or manage a building, and you run it in a way that promotes health, sources materials ethically and strategically minimizes its environmental impact, tenants will naturally want to live there.

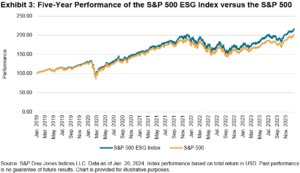

Market Outperformance

According to the ESG Market data firm ESG Book, stock funds outperformed across global markets over the last five years if they were weighted toward companies with positive environmental, social, and governance (ESG) scores (from 2017-2022). This includes periods of both bull and bear markets.

Transparency Drives the Free Market

ESG epitomizes the essence of transparency in free markets, offering investors a clear view of the risks and opportunities inherent in their potential investments. This level of clarity is indispensable for informed decision-making and strategic investment.

The Bottom Line: ESG as Strategic Business Wisdom

ESG embodies a pragmatic, forward-thinking approach to business, rather than a political tool. By viewing ESG integration as an investment rather than a cost, companies can significantly reduce expenses related to energy, employee turnover, and legal challenges. The real cost lies in overlooking the strategic value ESG brings to the table.

Take Action

Ready to deepen your understanding of ESG and its impact on your business? Explore our resources to gain insights and strategies for integrating ESG principles into your operations. Start your journey toward sustainability and resilience today by visiting:

Understanding ESG Data: The What, Why, and How

Transform your business practices for the better. Contact an ESG Expert and begin making a tangible difference through strategic ESG integration.