Every year, we publish a snapshot of the American economy—especially as it pertains to property management. Which could be construed as a silly thing for a utility management company to do, right?

After all, utilities may be the second highest operating expense for most property management businesses (regardless of industry), but it’s still a relatively small part of the overall market. The customers we serve are tangoing with everything from resident retention to zoning laws, to shifting inflation rights, to centralization and AI-assisted marketing, so why bother with the two cents of a property management firm based out of Utah?

Scale and scope, friends. Scale and scope.

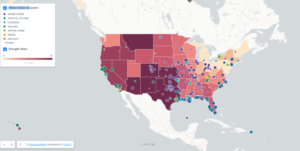

Utilities run the infrastructural gamut. They cross over into the regulatory landscape. They’re fundamental to new construction costs and the built environment. We’re the largest utility management provider in the U.S., which means the customers we support operate in wildly different municipalities and regions coast to coast. Utilities may be the invisible worm in the garden of your work—but that worm travels everywhere and is part of everything.

So here’s what we’re seeing, and what we think.

A Snapshot, if You’re Strapped for Time:

- Inflation’s been a part of this article for three years running. It remains a persistent factor, driving up the costs of labor, materials, and maintenance, and its fluctuations are impacting refinancing and development opportunities.

- Skilled labor shortages are complicating property upgrades and repairs, which are just one of many factors driving up operational expenses. That, plus the steady climb in utility costs (fueled by record high energy demands) is doubly tough since we’re operating in a flat-rent environment right now.

- The Feds are easing the way for sustainable energy projects while states are stiffening their ESG compliance requirements

- An uptick in extreme weather events is burdening our infrastructure and ruffling the feathers of insurers nationwide.

Utility Costs: Lines Go Up. Providers Lean In.

“The more we need the more it costs.”

The more we need the more it costs. Electricity demand is projected to rise to 4,185 billion kWh in 2025. While only a 2.42% YoY increase, what sets this growth apart from other fluctuating periods of high demand is that this rise is expected to remain steady. Various international, political, and economic factors aside, it’s a significant demand on an already strained supply chain.

According to Deloitte, the three key changes contributing to the increase in demand are:

In response to the uptick, and in pursuit of good housekeeping, utility providers nationwide are projected to increase their YoY investments in infrastructure. From grid-enhancing technologies to advanced conductors, their goal is to enhance the reliability and flexibility of existing transmission systems while lowering overall costs. Right now, these growth projects are due to voluntary commitments by providers. But several states throughout the U.S. have already signed bills requiring providers to lean into grid-enhancing tech.

ESG Regulations. Easier to Meet. But Sky High Standards.

“…transparency and measurability are being tethered to legislation, fines, and requirements.”

2025’s regulatory front has some good news and some tough news. The good news is that the Feds seem committed to at least simplifying the pursuit and completion of sustainable energy projects in our industry. Last year, the U.S. The Senate introduced the Energy Permitting Reform Act. Its goal is to streamline federal permitting and leasing procedures for a whole slew of energy related initiatives, including renewable energy developments. By establishing clear timelines and reducing bureaucratic hurdles, the act seeks to enhance energy infrastructure deployment, bolster national energy security, and stimulate economic growth. It’s worth noting that the bill has faced criticism from environmental groups who argue that it may favor fossil fuel interests and compromise environmental protections.

The tough news? The reporting and performance requirements that state legislatures are setting for the built environment grow more exacting each year. States throughout the U.S. last year and into this year have been proactive in setting ambitious Renewable Portfolio Standards (RPS) to encourage the adoption of renewable energy sources. It’s not a wholly new initiative. Colorado, for instance, became the first state to establish an RPS by ballot initiative all the way back in 2004. But there is a clear and measurable ramping afoot. While the RPS initially only required utilities to generate 10% of their retail electricity sales from renewable sources, by 2015, that target was raised to require investor-owned utilities to achieve 30% renewable energy by 2020. It’s a trend throughout the U.S., whether on utility provider electricity sourcing or operational standards for multifamily complexes or reporting requirements for Single Family portfolios, transparency, and measurability are being tethered to legislation, fines, and requirements.

Extreme Weather Has Its Foot on the Grid

“For property managers, these climate-driven economic shifts necessitate a proactive approach.”

A few months into the new year, climate-related disruption has already had a significant impact on our economy and our industry. Wildfires, hurricanes, heat waves, and winter storms, all statistically significant in either their timing or severity, have become more frequent and intense–impacting energy infrastructure and driving up costs. From damaged power lines to disrupted fuel supplies, they’re an especially nefarious source of grid demands because of their unpredictability. The result has been rising blackouts and skyrocketing energy prices.

For property managers, these climate-driven economic shifts necessitate a proactive approach to mitigating risk and controlling costs. With utility expenses making up a growing portion of operational budgets, investing in climate-resilient infrastructure is no longer optional—it’s a financial imperative. Battery storage systems, on-site renewable energy solutions, and smart grid technology can help properties maintain power during outages and reduce reliance on increasingly expensive grid electricity. Additionally, reinforcing buildings against climate stressors—through better insulation, flood-resistant construction, and heat-mitigation strategies—can prevent costly damage and ensure tenant safety. As energy markets react to climate volatility, property owners who take these steps will be better positioned to stabilize expenses and maintain asset value in an increasingly unpredictable economy.

In Conclusion, Stay Ahead

If there’s one thing property management teaches us again and again, it’s that everything is connected. The economy, energy markets, regulations, climate events—they don’t exist in silos. They overlap, push, and pull against each other in ways that can either throw a wrench in your operations or, if you’re ahead of the game, create opportunities to strengthen your portfolio. Utility management may seem like a small piece of that puzzle, but it’s an essential one. It’s the thread that weaves through operating costs, compliance, infrastructure resilience, and even resident retention. When utilities are predictable, affordable, and well-managed, they enable stability elsewhere. When they aren’t, well… just ask anyone who’s tried to budget around last year’s energy price spikes.

So what’s the move in 2025? Pay attention to the long game. Grid-enhancing tech and infrastructure investments are coming, but so are stricter ESG mandates and rising energy demands. Climate volatility isn’t going anywhere, which means building resilience—both in energy strategy and property operations—needs to be part of the financial plan. Property managers who treat utility management as an afterthought will find themselves playing defense, scrambling to adapt to higher costs, outages, and regulatory headaches. Those who plan ahead, invest in efficiency, and stay informed? They’ll be the ones setting the standard for sustainability, cost control, and operational success in an industry that’s always evolving.