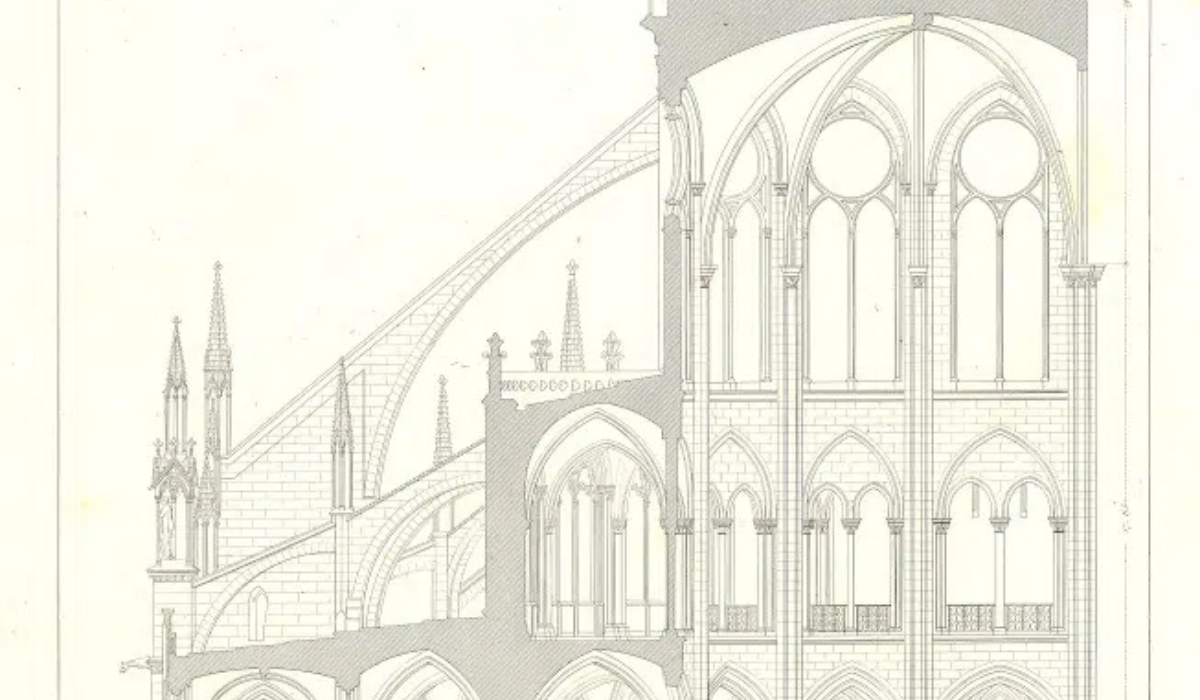

When the architects of Notre Dame in Paris drafted their plans for the cathedral in the 11th century, they put in motion a project that would take centuries to complete.

Thomas Stanchak of Stoneweg US is an architect of sustainability for the company’s moderate income multifamily portfolio and knows the ultimate goals he’s set for the company’s environmental performance won’t be achieved until long after he’s retired, yet he continues his part in progressing toward success – brick by brick (or heat pump by heat pump).

Meet

Thomas Stanchak

Meet Thomas Stanchak: As Managing Director of Sustainability at Stoneweg US, Thomas is well versed in commercial real estate operations, asset management, and all things ESG. Like many born into entrepreneurial families, his career journey began early in life, spending much of his time outside of school at his family businesses – a gas station, a bar, and a small portfolio of apartment buildings across the street from a steel mill in northeast Ohio, near the shore of Lake Erie. These early experiences in all these different contexts taught Thomas the fundamentals of how tools, machines, buildings and people operate.

You started working young.

HOW DID YOU GET INTO REAL ESTATE?

“It all began with my family. My father, an immigrant, worked in a mill that forged cranes for construction before he began investing. He invested in apartment buildings, a bar, and a gas station, so real estate was part of my life from the start. I spent my childhood collecting rent, posting notices, and learning the business side at our kitchen table. We used physical books, accounting ledgers, to track rent charges, payments and expenses, giving me a hands-on education in what it takes to make a living providing a home for people.

“I learned early on the balance between supporting residents through tough times and meeting our obligations to lenders, service providers and tax collectors. That experience shaped my approach to real estate—it’s possible to treat people fairly, be a good steward and find opportunity even in difficult circumstances.”

Good landlords can be hard to come by.

WHAT CHANGES DID YOU MAKE TO HELP YOUR TENANTS?

“My first adult job in the industry was managing a high-rise in Cleveland. At a young age, I was responsible for a million square feet of Class A office space. It was fully leased long term, which allowed me to focus on optimizing performance. This is where I started my first conservation projects, like moving from T12 to T8 fluorescent lights, which improved the energy efficiency of lighting 20%—incremental changes that, even back then demonstrated the opportunities from making investments to drive improved performance.

“Looking back on those projects from 25 years ago, I see now that they were just the beginning. I’m optimistic about the future because we’re continually improving, and today’s technology is a major leap forward from what we had back then. Looking ahead, I believe we’re only catching a glimpse of what’s yet to come.“

You’ve talked about “cathedral thinking” before.

HOW DOES THAT APPLY TO SUSTAINABILITY?

“I think about our work in sustainability much like the people who built cathedrals. Most of the craftsmen, tradesmen, and architects who designed and built Notre Dame didn’t live to see it finished, and that’s how I view sustainability—it’s a long-term project. I aim for 5-6% annual improvements, knowing that the big changes will come from future generations, largely with tools we haven’t even invented yet.

We can, however, make progress with what we have now. GHG inventories and carbon accounting help us understand our emissions, and that knowledge leads to action. For instance, by the end of this year, our company will have deployed solar that offsets about 2% of our scope 2 emissions. Next year, we aim for 5%. These incremental steps are how we reach 50% decarbonization.”

Loans are expensive. Inflation is high.

WHY SHOULD WE MAKE SUSTAINABILITY A TOP PRIORITY?

“Beyond doing the right thing for the planet, sustainability is a strategic advantage. The future of real estate lies in understanding your portfolio’s environmental impact. If you grasp it, you can arbitrage and trade it, giving you a competitive edge. Those who don’t keep up will be left behind.”

Sustainability as a competitive edge…

CAN YOU ELABORATE?

“Sure. I like to think of this as a two part strategy. The first part is those small incremental changes you can make. The other part, frankly, is that sustainability gives you a leg up on your competition. If you don’t know the aspects of your portfolio, at least on an individual asset basis, you’re behind. People who do understand it can monetize it.”

“My mission is to make sustainability a part of every business strategy.”

You’ve supported this industry for decades.

WHAT ADVICE DO YOU HAVE FOR PROPERTY OWNERS?

“My advice to property owners and managers: understand your portfolio’s emissions and make ESG part of your business plan. ESG can drive NOI by reducing costs through energy efficiency and by making properties more attractive to tenants and investors alike.”

What do you see next for

THE FUTURE OF ESG?

“Over the years, I’ve seen a major shift in how the property management industry views ESG. What was once a “nice to have” is now essential. As we move forward, technology will continue to evolve, regulations will tighten, and the companies that stay ahead of these changes will be the ones that thrive.”

Follow Thomas on LinkedIn

Hear from more experts in tech and utility management at Conservice.