Some think it’s the underrated investment strategy of the future. Others in the industry insist it’s a crazed phase doomed to settle into a niche offering. But wherever you land on the will-they-won’t-they of build-to-rent (BTR) investments, they’re growing. From mainstage topics at NAA to a 5-10% jump just last year in the number of BTR new construction projects, multifamily businesses across the U.S.—but especially in the sunbelt–are either outright investing or paying very close attention to BTR as a way to offset stagnating rents and even more stagnated multifamily property sales in order to grow their portfolios.

But if there is a theme to our blog here at Conservice, it’s that anything and everything that touches utilities is more complicated and strangely nuanced than first glance would admit. Many of our clients and partners have pulled the trigger on BTR. And many have assumed that, for all of the obvious sophistication that building new individually platted properties would confer, utility management would be comparatively easy.

After all, there are typically no common areas or shared utility lines. No RUBS to consider. Just make residents responsible for setting up and paying their own utilities, leave your staff out of it, and sit back.

Tragically, more often than not, it’s a nonscalable, headache-inducing strategy that grows exponentially worse and more expensive the larger your portfolio grows.

BTR Can’t be Business as Usual

There’s a lack of visibility when utilities are renter-controlled. In traditional multifamily settings, utility management offers a dependable layer of visibility and control. Your property gets the bill, you know your vacancy rates, move-ins, and move-outs, and you have your allocation tools (RUBS, individual meters, etc.). But when renters handle their utilities independently in a BTR setup, owners lose crucial oversight into the frequency and dependability of payments. When residents miss utility payments or move out abruptly without attending to the change of responsibility, it can leave your business on the hook for the vacancy period and your property in peril.

Utility disconnects and the risk of infrastructure damage. Properties, like living organisms, break down when they aren’t protected from the elements. Properties with renter-controlled utilities are at greater risk of disconnects between renters, and during the more extreme months of the year, the results can be devastating. In colder climates, disconnects can mean frozen pipes and nightmare flooding; in warmer areas, disconnects can lead to the onset of black mold; and maintenance workers arriving at a property only to find the utilities shutoff is an all too common and frustratingly expensive delay.

Fundamentally, property owners can’t enhance or control what they can’t measure, and they can’t measure what they can’t see. Any property owner interested in building and renting new structures on individual plats should first and foremost

OUR ADVICE? ESTABLISH A CONTINUOUS SERVICE AGREEMENT

Any property owner interested in purchasing or building a property for rent on an individual plat should first and foremost look into establishing a continuous service agreement (CSA) with their property’s utility companies. These agreements ensure that your properties won’t lose power, heat, or water even when a resident exits without paying.

Of note: CSAs are Easier for Master-Platts Than Individually-Platted Properties

One of the most crucial distinctions in BTR is whether a property is master-platted or individually platted. For master-platted properties, implementing a CSA is much simpler, leading to streamlined operations and reduced risk of service interruptions. Individually platted properties, however, often lack the infrastructure for a CSA, meaning that each unit’s utilities may need to be activated independently. In such cases, owner-held utility agreements provide a workable solution but require careful planning to avoid additional administrative burdens.

Owner-Held Utilities: A Proactive Solution

In our experience (which includes over twenty years of shepherding properties throughout the U.S.), owner held utilities lead to better outcomes and better scalability. It’s not an especially intuitive strategy—you’d think that letting residents handle utilities would be easier than handling them yourselves—but the lack of visibility and the risk to the property far outweigh the infrastructural burden of dealing with them yourself.

An owner-held approach:

- Simplifies utility activation

- Lowers costs

- Increases visibility

- And eliminates service interruptions

Plus, an owner-held system offers tenants an added convenience: no activation fees, no deposit, and a consolidated utility bill, making the move-in process seamless.

ABSORBING A SMALL RISK TO OFFSET A BIG ONE

Now, don’t get us wrong, owner-held utilities aren’t without their risks too. In fact, the key risk of owning property utilities yourself is the same risk you assume in a multifamily property—you’re financially on the hook during vacancy periods. However, consider the following:

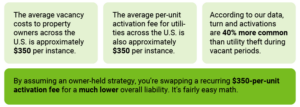

By assuming an owner-held strategy, you’re swapping a recurring $350-per-unit activation fee for a much lower overall liability. It’s fairly easy math.

BTR in Deregulated Markets? A Possible Revenue Stream.

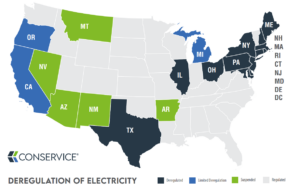

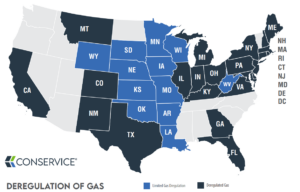

Buying power is a force to be reckoned with in every market. Owning the utilities for properties in masse often gives you the leverage you need to negotiate with multiple energy providers and secure more favorable rates. In some jurisdictions, utility providers can even offer incentives for securing residents on specific plans. The cost savings and incentives can add up over the breadth of a portfolio, and it’s a criminally underutilized strategy in the many deregulated utility markets throughout the U.S.

Of note: BTR Utilities are Inherently Harder to Scale

BTR utility management is just more complex and difficult to scale than traditional multifamily properties. In multifamily, utilities like water, sewer, and trash are typically shared across units, leading to a lower volume of invoices and consolidated billing. BTR properties, however, have separate bills for each unit. This higher administrative load calls for automation solutions to streamline processes and manage the increased invoice volume more efficiently.

Simplifying the Complexities of BTR Utilities Management

Managing utilities for BTR requires a fresh approach that accounts for the unique structure and demands of this property class. From leveraging owner-held agreements to minimizing vacancy risks, property managers can navigate these complexities with foresight and careful planning. With nearly two decades of experience in utility management, our team understands the challenges and can guide you through strategies to ensure your BTR investments are protected and profitable. Don’t let small oversights turn into large expenses—consider a tailored utility management approach for your BTR properties today.